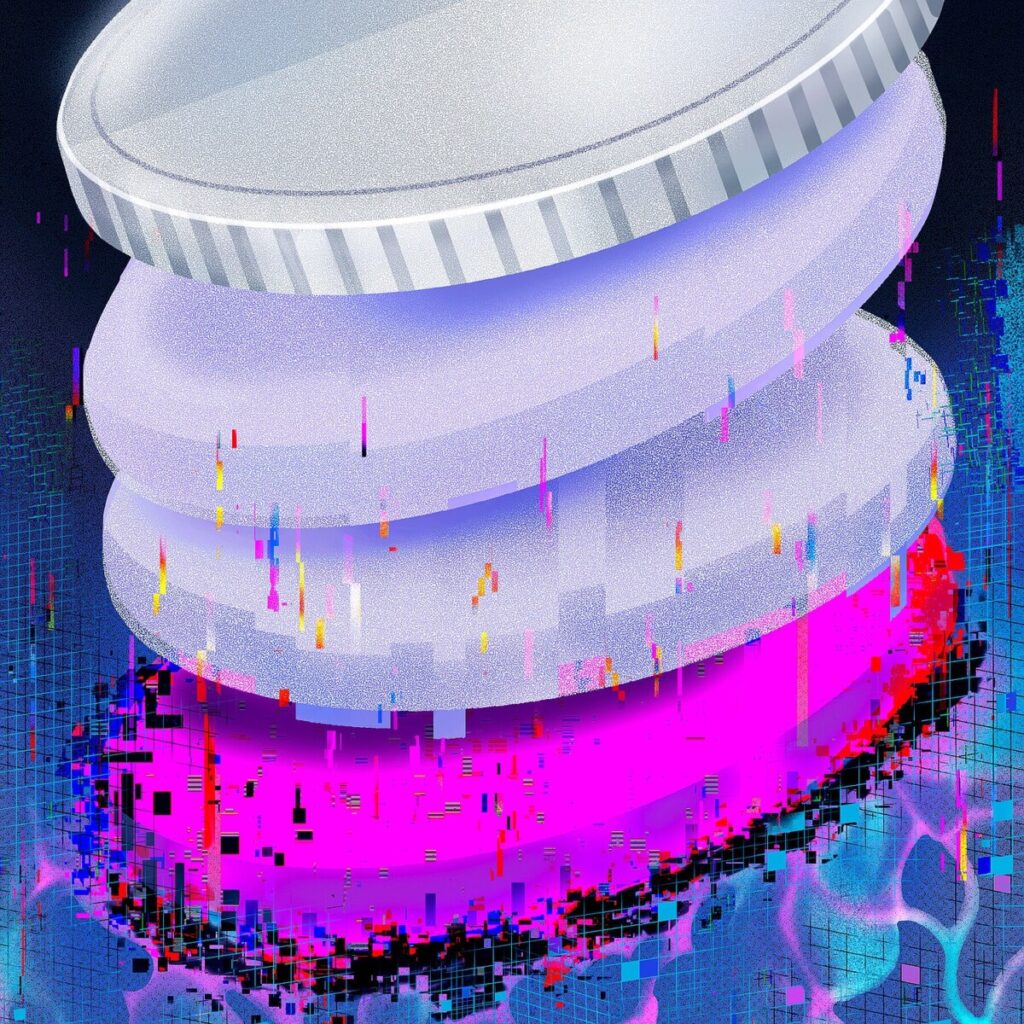

How Stablecoins Can Help Criminals Launder Money and Evade Sanctions

In the complex world of cryptocurrency, stablecoins have emerged as a popular digital asset, often lauded for their ability to maintain a stable value tied to traditional currencies like the US dollar. However, a new layer of concern has arisen regarding the potential for these digital currencies to be exploited for illicit activities. Experts warn that the mechanisms through which stablecoins are transferred, swapped, and mixed can create a murky environment that obscures the flow of funds, making it challenging for regulators and law enforcement to trace transactions effectively. This opacity is primarily due to the involvement of multiple intermediaries and the use of mixing services, which aggregate various transactions to enhance privacy and anonymity.

For instance, when a stablecoin is moved through a series of intermediaries—such as exchanges or decentralized finance (DeFi) platforms—it can be combined with other funds, creating a convoluted trail that is difficult to follow. This layering effect is akin to washing money through a series of transactions to disguise its origin. In practice, this means that individuals looking to launder money or engage in other illegal activities can leverage stablecoins to navigate around traditional financial systems, which are typically more transparent and regulated. As these digital assets gain traction, especially in regions with less stringent financial oversight, the potential for misuse raises alarms among regulators who are already grappling with the challenge of keeping pace with the rapid evolution of cryptocurrency technology.

The implications of this trend are significant for both the cryptocurrency market and regulatory bodies. As stablecoins become integral to the financial ecosystem, their ability to facilitate anonymous transactions poses risks not only to financial integrity but also to broader economic stability. For example, the rise of decentralized exchanges (DEXs) has further complicated the regulatory landscape, as these platforms often operate without a central authority, making it difficult to enforce compliance with anti-money laundering (AML) and know-your-customer (KYC) regulations. As experts continue to analyze these dynamics, it is clear that a balanced approach is needed—one that fosters innovation in the cryptocurrency space while also implementing robust safeguards to prevent misuse and protect the integrity of financial systems.

https://www.youtube.com/watch?v=CEsS0nDm4Rk

Through layers of intermediaries, stablecoins can be moved, swapped and mixed into pools of other funds in ways that are difficult to trace, experts say.