Here’s what Warner Bros. Discovery CEO David Zaslav said about the Netflix deal at a company town hall

In a recent town hall meeting, Warner Bros. Discovery (WBD) CEO David Zaslav shared an optimistic outlook regarding the company’s monumental $72 billion merger with Netflix, a deal set to reshape the media landscape significantly. During the meeting, Zaslav emphasized Netflix’s strengths, stating, “Netflix is an exceptional company” with “a great, sustainable future,” which reflects a hopeful vision for the integration of both companies. The merger will see Netflix acquiring WBD’s studio and streaming assets, including major brands like HBO and HBO Max, while WBD’s TV networks, such as CNN and TNT, are planned for a spinoff in mid-2026. This strategic move comes amidst concerns from WBD employees regarding job security, as Netflix’s advanced technology could potentially render some of WBD’s operations obsolete. Zaslav reassured staff that Netflix aims to retain most employees, indicating a commitment to maintaining workforce stability during this transition.

The announcement of the merger has generated a mix of excitement and apprehension within the industry. Zaslav noted that while the deal is a significant step forward for WBD, it also marks the end of an era for the company as it prepares to navigate the complexities of a major acquisition. He highlighted that WBD’s stock has seen a substantial increase since rumors of the acquisition began, emphasizing the importance of driving shareholder value. As the bidding process attracted interest from other major players like Paramount and Comcast, Zaslav expressed pride in the attention WBD garnered, stating that it was a testament to the company’s value. He also acknowledged that the regulatory approval process for the merger could take 12 to 18 months, but he remains confident in its successful completion.

In a separate call with analysts, Netflix co-CEOs Ted Sarandos and Greg Peters framed the acquisition as a strategic move to enhance the company’s production capabilities and expand its original content offerings. They acknowledged that such large-scale acquisitions are atypical for Netflix, which has historically focused on organic growth rather than mergers and acquisitions. However, they believe this deal will ultimately benefit investors, fans, and the broader entertainment industry by creating new jobs and opportunities for creative talent. Despite the optimism surrounding the merger, analysts have cautioned that Netflix faces a challenging regulatory landscape, with potential pushback from industry groups concerned about market consolidation. As both companies move forward, the implications of this merger will undoubtedly be felt across the media industry, making it a pivotal moment in the evolution of entertainment content delivery.

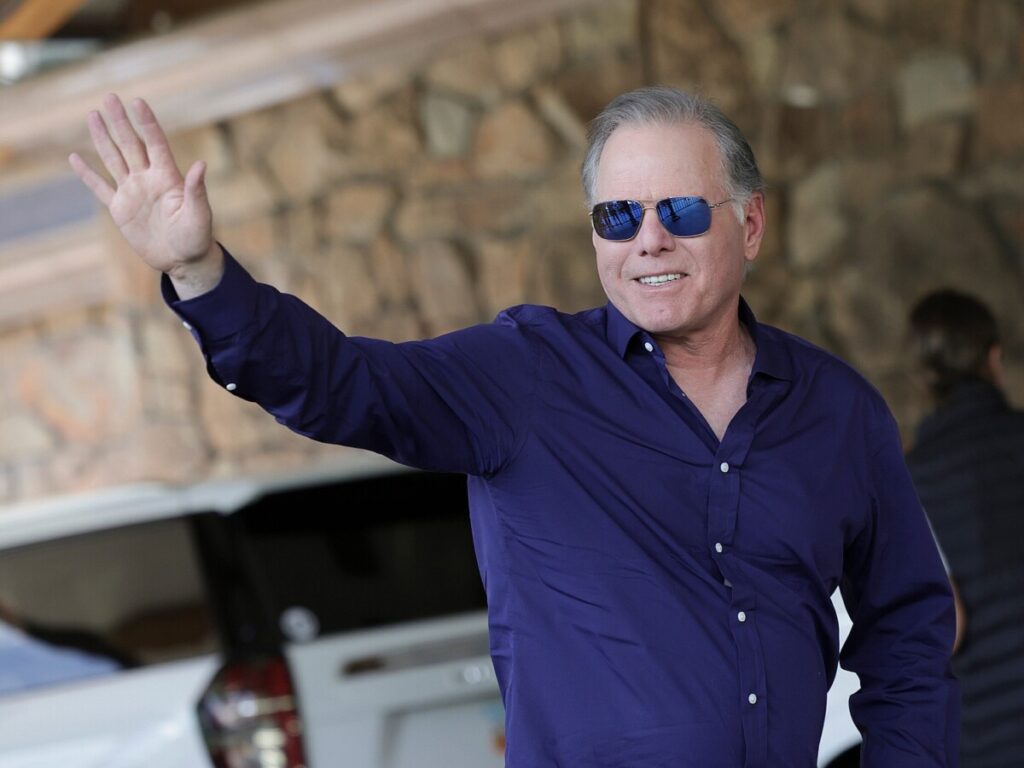

Warner Bros. Discovery CEO David Zaslav addressed employees at a company town hall.

Kevin Dietsch/Getty Images

The Netflix-Warner Bros. Discovery deal would be one of the biggest ever in the media industry.

WBD CEO David Zaslav gave an optimistic vision of the road ahead in a town hall on Friday afternoon.

“Netflix is an exceptional company” with “a great, sustainable future,” Zaslav told staffers.

Warner Bros. Discovery CEO David Zaslav presented an upbeat take on the company’s

new mega-merger with Netflix

during a Friday all-hands with employees.

“This is a big day for Warner Bros.,” Zaslav said at a company global town hall, a recording of which was obtained by Business Insider.

Netflix plans to buy

the Warner Bros. studio and streaming assets — which include Warner Bros., HBO, and HBO Max — in an industry-shaking $72 billion deal, the companies announced on Friday. WBD’s TV networks like CNN and TNT will be

part of a spinoff

in mid-2026, as the media conglomerate had originally planned.

WBD’s town hall on Friday afternoon at 1:30 pm ET seemed designed to answer employees’ questions and assuage potential fears about the Netflix deal. Zaslav also sent

a memo to staffers

, several of whom told BI they were worried about their job security as the company undergoes another major deal. That’s especially true because Netflix has its own top-tier tech that could render some of WBD’s obsolete.

“The intention is, that they want to keep most people,” Zaslav said of Netflix on the call.

Netflix said Friday it expected $2 billion to $3 billion in savings from the deal, a signal that there would likely be layoffs.

Zaslav suggested HBO Max would continue to operate after the Netflix deal closes.

“HBO Max will stay,” Zaslav said. “So anybody that has Netflix and has HBO Max will have a better experience. For people that only want HBO Max, they’ll be able to get it.”

A person familiar with Netflix’s thinking said that for the foreseeable future, HBO Max and Netflix would continue to operate as separate brands and services.

WBD CFO Gunnar Wiedenfels, who will lead Discovery Global after it’s spun off from the main company, said on the call that while the WBD as the world knows it would come to an end, he’s excited for the future.

“It’s an emotional day, I think, for all of us,” Wiedenfels said.

What WBD execs said about the split, bidding war, and sale

Early on the call, Zaslav acknowledged that WBD and its employees had gone through a slew of changes since he engineered a

merger between WarnerMedia and Discovery

that closed in 2022.

“In the end, we’ve gotten a lot more right than we’ve gotten wrong,” Zaslav said.

WBD’s stock has more than doubled to nearly $26 per share since news of Paramount’s interest in buying it broke in mid-September. However, WBD shares began trading at $24.08 in April 2022 and closed at $12.54 before acquisition rumors heated up.

The WBD CEO reiterated on the call that the company had planned to split itself before Paramount expressed its interest with an unsolicited offer. Zaslav said that, as a public company, it was executives’ duties to get the best possible offer.

“Our No. 1 focus is to drive shareholder value,” Zaslav said.

As Netflix, Paramount, and Comcast put forth offers, Zaslav said that the bidding war got noisy.

“It was more public than we would have liked,” Zaslav said of the bidding process.

WBD employees should be flattered by the interest from Netflix and other companies, Zaslav said.

“They wanted to figure out how to get into business with all of you,” Zaslav said of WBD’s suitors. He also said there may be more noise ahead, so “put your seatbelts on.”

In the end, WBD executives told employees that they took the best offer on the table.

“Netflix is an exceptional company,” Zaslav said. “I think it has a great, sustainable future.”

As Netflix incorporates HBO Max content, Zaslav said that “more people will be getting nourished” by HBO and Warner Bros. content.

WBD executives expressed confidence that the Netflix deal would close, though the companies have said that they think it will take 12 to 18 months.

“We’re confident in receiving regulatory approvals for the transaction, but the process is going to take some time,” said Priya Aiyar, WBD’s chief legal officer.

Netflix execs also shared their views on the deal

After announcing the blockbuster deal on Friday, Netflix also moved to answer questions from

Wall Street analysts and investors

.

Netflix co-CEO Ted Sarandos acknowledged on a call with analysts that big deals are out of character for the company.

“I know some of you’re surprised that we’re making this acquisition, and I certainly understand why,” Sarandos said. “Over the years, we have been known to be builders, not buyers.”

But Sarandos and his counterpart, co-CEO Greg Peters, said the Netflix-Warner Bros. deal is a win for investors of both companies, TV fans, and the entertainment industry.

Peters said on the call that “this acquisition will allow us to significantly expand our production capacity in the United States and keep investing in original content over the long term. That means more opportunities for creative talent; it means more jobs created across the entire entertainment industry.”

Some media analysts see a tough road ahead. Ben Swinburne of Morgan Stanley told clients last month that Netflix had “perhaps the toughest regulatory path” among the suitors for WBD’s assets.

Though Netflix said it would still release

Warner Bros. movies in theaters,

the movie theater trade group Cinema United came out swinging against the deal. The bigger question, however, is

what President Donald Trump

and his administration think.

Read the original article on

Business Insider