Disney and YouTube TV have made peace, but you can expect more blackouts in 2026

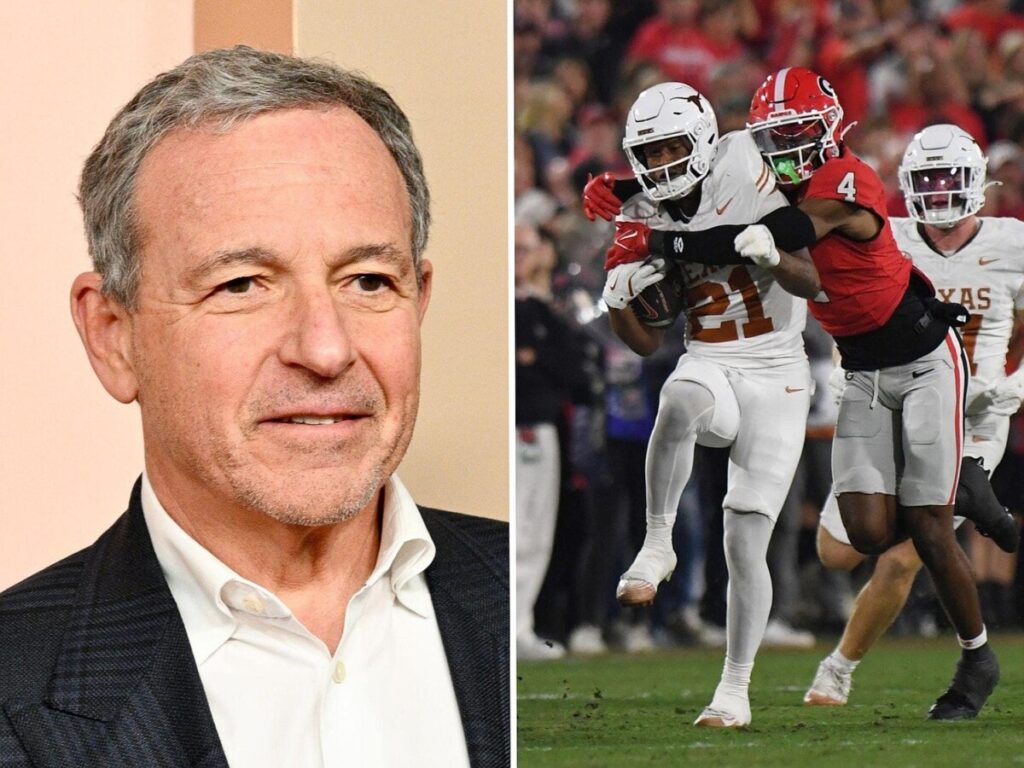

YouTube TV subscribers rejoiced this past weekend as Disney-owned channels, including ESPN, returned to the platform after a protracted 15-day blackout—the longest carriage dispute in Disney’s history. The resolution came just in time for college football fans, allowing them to catch exciting matchups like the Georgia Bulldogs’ victory over the Texas Longhorns. The standoff stemmed from disagreements over the valuation of Disney’s networks, which are seen as essential for any major TV provider due to their lucrative sports rights. Disney’s recent annual report, however, casts a shadow over this victory, warning that more blackouts could occur as distribution contracts with pay-TV providers, set to expire in 2026, may lead to similar disputes in the future.

Media analyst Alan Wolk pointed out that the ongoing trend of cord-cutting has put pressure on both media firms and pay-TV providers, leading them to squeeze existing customers for higher fees. This situation creates a precarious environment where media companies feel empowered to demand more money for their valuable content. As the number of pay-TV subscribers dwindles, the balance of power is shifting; providers like YouTube TV, backed by tech giant Google, wield significant leverage in negotiations. In fact, Google indicated that agreeing to Disney’s pricing demands would necessitate another increase in YouTube TV’s subscription costs within the same year, further complicating the relationship between content providers and distributors.

The landscape of pay-TV is evolving, with companies like Charter rethinking their strategies to combat declining subscriber numbers. By bundling streaming services with traditional cable offerings, Charter has managed to slow its rate of cord-cutting significantly, losing only 70,000 video subscribers in the third quarter of this year compared to 294,000 in the same period last year. This approach has not only helped retain customers but also reflects a broader trend among cable and satellite providers, including DirecTV and Dish, who are experimenting with “skinny bundles” that focus on delivering essential channels at a lower price. As the TV industry grapples with these challenges, the potential for future disputes looms large, leaving sports fans and other viewers to navigate a landscape fraught with uncertainty.

YouTube TV subscribers could watch Disney-owned networks like ESPN again this past weekend, including college football games like the Georgia Bulldogs’ win over the Texas Longhorns.

Jeffrey Vest/Icon Sportswire via Getty Images

Disney and YouTube TV reached a deal late last week after a lengthy blackout.

The two sides were divided on how much Disney’s networks like ESPN are worth.

Sports fans can expect similar carriage disputes in 2026.

Disney recently gave sports fans a cause for celebration — and a reason for dread.

The good news: Disney’s

long-running fight with YouTube TV

is over. Disney-owned channels, including ESPN,

returned to YouTube TV

on Friday night after a 15-day blackout, marking

Disney’s longest carriage dispute

to date.

The bad news: Disney warned in its latest annual report that more

TV blackouts may be ahead

. Disney has distribution contracts with pay-TV providers expiring in its fiscal year 2026, and told investors in its yearly 10-K form that negotiations “could lead to temporary or longer-term service blackouts.” These contracts can vary in length but typically last for three to five years.

“There’s a good chance” that carriage disputes between media firms and pay-TV providers will become commonplace in 2026, given the state of the TV industry, media analyst Alan Wolk of TVREV told Business Insider.

“There’s fewer and fewer video viewers,” Wolk said, referring to pay-TV subscriptions. “And I think that the media companies are just like, ‘OK, now we can really press our advantage.'”

As the

cord-cutting movement continues

, media firms and TV providers have tried to protect their businesses by squeezing existing customers for more money. That has created a vicious cycle where fewer people have a pay-TV subscription, except for die-hard fans of sports or cable news.

Disney’s argument, as Wolk noted, is that it owns

highly valuable sports rights

that make its networks a must-carry for any major TV provider.

But at some point, pay-TV customers could balk at how high their monthly bills have gotten. Google had said that paying Disney’s desired rates would have required it to

raise YouTube TV’s price

for the second time in a year.

YouTube TV had substantial leverage in its fight with Disney because of its backing by parent company Google. And while cable companies have been hit by cord-cutting, some are becoming less reliant on pay-TV subscriptions, which gives them their own leverage.

“TV is, at this point, a loss leader” for cable company Charter, Wolk said. He added that the video subscription business is primarily a way to retain broadband internet customers and “create stickiness” than to attract cord-nevers, or people who’ve never paid for cable.

Charter is thinking outside the cable box. The cable giant reached a deal with Disney in 2023 to bundle streaming services in its cable video package, a model that rival cable providers have since followed. While this isn’t a foolproof solution to

pay-TV’s imperiled business model

, it has helped slow Charter’s cord-cutting rate, as analyst Craig Moffett of research firm MoffettNathanson has noted.

“Charter is enjoying a remarkable turnaround driven by its bundled streaming packages,” Moffett wrote in a late October note, adding that it lost just 70,000 video subscribers in the third quarter, compared to 294,000 a year earlier. “The results are nothing short of extraordinary.”

Charter reduced its cord-cutting rate earlier this year by bundling streaming services in its cable package.

MoffettNathanson

Cable companies like Charter and Comcast aren’t the only players in the pay-TV market. There are also satellite providers, such as DirecTV and Dish, as well as virtual TV services like YouTube TV, Fubo, and Hulu + Live TV.

DirecTV doesn’t have a backup business like broadband internet, but it’s also starting to experiment with bundling streamers. And it’s trying a strategy centered on so-called

“skinny bundles” built around sports

, news, or entertainment. Its pitch is that customers can get the channels they watch most, while paying less.

Media giants like Disney must get enough value for their networks to please investors, but TV providers increasingly have reasons not to back down. That could lead to more fights in 2026, and sports fans might get caught in the crossfire.

Read the original article on

Business Insider

Eric

Eric is a seasoned journalist covering Business news.