Crypto Investor Known as ‘Bitcoin Jesus’ Reaches Deal With Prosecutors

Roger Ver, a prominent figure in the cryptocurrency world often dubbed “Bitcoin Jesus,” has recently found himself in legal trouble as he faces serious charges of fraud and tax evasion. According to reports, Ver is accused of failing to pay approximately $48 million in taxes related to his extensive cryptocurrency holdings. This situation has raised eyebrows in the crypto community, particularly given Ver’s history as an early Bitcoin investor and advocate for digital currencies. His advocacy for cryptocurrency has often centered on the belief in a decentralized financial system, but his current legal issues highlight the complexities and responsibilities that come with such investments.

The allegations against Ver are significant, as they underscore the increasing scrutiny that cryptocurrency investors face from tax authorities. The Internal Revenue Service (IRS) has been ramping up its efforts to ensure that individuals and businesses report their cryptocurrency transactions accurately and pay the taxes owed on them. Ver’s case serves as a cautionary tale for other crypto investors, illustrating the potential consequences of neglecting tax obligations in a rapidly evolving financial landscape. In recent years, the IRS has been actively pursuing individuals who fail to report their crypto earnings, and Ver’s situation could set a precedent for how similar cases are handled in the future.

Ver’s legal troubles come at a time when the cryptocurrency market is experiencing both volatility and growth. As an early proponent of Bitcoin and other digital currencies, Ver has played a significant role in promoting the adoption of cryptocurrencies. However, the juxtaposition of his advocacy with his current legal challenges raises questions about accountability in the crypto space. Investors and enthusiasts alike are now left to ponder the implications of Ver’s case, not only for his personal future but also for the broader cryptocurrency ecosystem, which continues to grapple with regulatory challenges and the need for clearer guidelines regarding taxation and compliance.

Related articles:

– Link 1

– Link 2

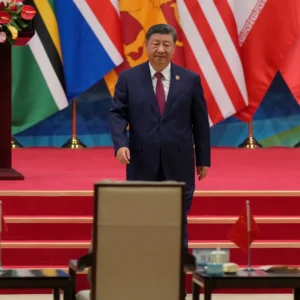

Roger Ver, shown in 2013, was charged with fraud and tax evasion for failing to pay $48 million in taxes that he owed on his cryptocurrency holdings.

Eric

Eric is a seasoned journalist covering US Tech & AI news.