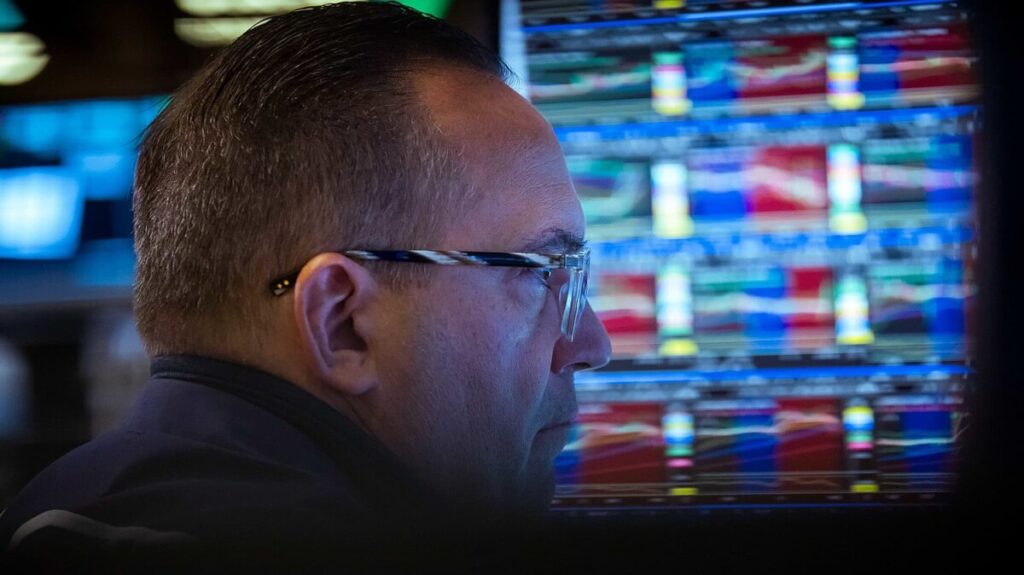

Hot tech stock ETFs, from AI to quantum computing, have made investors lots of money. Is it time to sell?

The rise of artificial intelligence (AI) has significantly transformed the investment landscape, emerging as a dominant theme in the financial markets. As companies increasingly integrate AI technologies into their operations, investors are flocking to thematic investing and exchange-traded funds (ETFs) that focus on this burgeoning sector. The allure of AI-driven funds is underscored by the impressive performance of stocks in this space, with major players like NVIDIA and Microsoft witnessing substantial gains as they capitalize on AI advancements. The enthusiasm surrounding AI has led to a proliferation of thematic ETFs, which offer investors a diversified approach to capitalizing on this trend, allowing them to invest in a basket of companies poised to benefit from AI innovations.

However, experts caution that the excitement surrounding AI-themed investments comes with inherent risks. While the potential for growth is significant, the volatility of these funds can be equally pronounced. Historical patterns suggest that thematic ETFs can experience rapid rises in value, but they are also susceptible to sharp declines, often influenced by market sentiment and broader economic factors. For instance, the recent downturn in tech stocks has led to a reevaluation of AI investments, highlighting the precarious nature of chasing trends without considering underlying fundamentals. Investors are urged to conduct thorough research and remain vigilant, as the very characteristics that make AI an attractive investment—its transformative potential—can also lead to unpredictable market dynamics.

In conclusion, while AI represents a thrilling frontier for investors, the current enthusiasm for thematic investing and AI-focused ETFs should be approached with caution. The market’s appetite for innovation can drive prices up quickly, but the same forces can lead to equally swift corrections. As the landscape continues to evolve, a balanced approach that weighs both the opportunities and risks of investing in AI will be crucial for long-term success. Investors are encouraged to stay informed and consider the broader implications of their investment choices in this rapidly changing environment.

AI has become the market’s biggest story, helping drive a surge in thematic investing and ETFs. But experts warn these funds can fall as quickly as they rise.

Eric

Eric is a seasoned journalist covering US Politics news.