The seven deadly sins of corporate exuberance

In recent years, America Inc. has found itself in the throes of a remarkable surge in financial innovation, bringing both excitement and concern to the forefront of the corporate landscape. This wave of innovation, characterized by the rise of complex financial instruments, digital currencies, and sophisticated algorithms, has transformed the way businesses operate and interact with capital markets. While these advancements promise increased efficiency and potential profitability, they also raise critical questions about risk management and regulatory oversight. The rapid pace of change has left many experts pondering the implications of these innovations on the broader economy.

One of the key examples of this financial frenzy is the proliferation of special purpose acquisition companies (SPACs), which have become a popular vehicle for taking companies public. SPACs offer a faster and often less rigorous alternative to traditional IPOs, attracting a slew of investors eager to capitalize on the latest trends. However, this enthusiasm has led to concerns about transparency and the potential for inflated valuations, as seen in numerous high-profile SPAC deals that have faltered post-merger. Additionally, the rise of cryptocurrency and blockchain technology has introduced new dimensions of volatility and speculation, with companies rushing to adopt these technologies without fully understanding the associated risks. The recent collapse of several high-profile crypto exchanges serves as a stark reminder of the dangers that can accompany unregulated financial innovation.

Moreover, the integration of artificial intelligence (AI) and machine learning into financial decision-making processes has raised alarms about the potential for systemic risks. Companies are increasingly relying on algorithms to make investment decisions, which can lead to herd behavior and exacerbate market fluctuations. As firms navigate this complex landscape, the need for robust regulatory frameworks becomes more pressing. Policymakers are grappling with how to balance innovation with consumer protection, ensuring that the benefits of financial innovation do not come at the expense of stability and accountability. As America Inc. continues to embrace this financial revolution, the question looms: what could go wrong, and how can stakeholders mitigate the risks inherent in this brave new world of finance?

A frenzy of financial innovation has ensnared America Inc. What could go wrong?

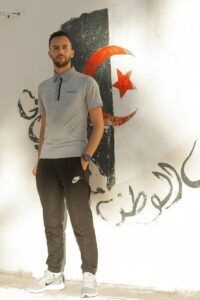

Eric

Eric is a seasoned journalist covering Business news.